A totally logical breakdown of why “I can’t afford to travel” is a lie. With numbers to prove it.

According to NAFSA, in the 2013-2014 academic school year, only 1.5% of U.S. college students studied abroad. This is sad, but I somewhat understand. Studying abroad is more expensive than a traditional college term, and it takes you away from your college/university for a whole semester or year. Miss out on college football games, what?? No way.

But that isn’t to say that you can’t travel on your own.

The new “American Dream”

Traveling abroad is something that so many people dream of, yet few actually get the chance to do. The most common excuse I hear is “I don’t have enough money.” And while that is a very real setback for some, I have a response for the rest of you:

“Yes you do. You just choose to spend it on other things.”

For the sake of this blog post, I am going to assume you are a college student. Why? Because college students are some of the brokest b!+(#35 I know, and they are prime candidates for travel – also, most of the people I know are around this age. Without a career, kids or mortgage obligations, you are at an ideal point in your life to travel. You just choose to spend your money on other things instead of saving for travel.

What’s in your wallet?

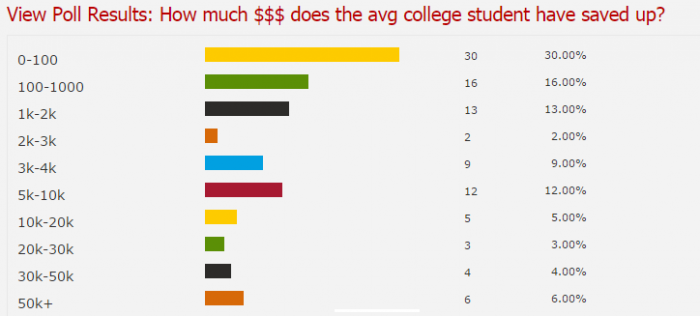

If you’re serious about traveling, let’s start out by figuring out what you already have. Out of 100 college students surveyed by bodybuilding.com, 41% of them had over $2,000 saved up. Oh, you’re poorer than that? Well then let’s begin at an even lower starting point. That brings us to 54% of college students have over $1,000 saved up. That’s more than half of you guys.

Okay maybe I’m being a little ambitious with the survey. Even still, nearly 3/4 of you have at least something (>$100) saved up. So 3/4 of you have proven that you are capable of saving money.

That’s a start.

College spending habits

So you’ve got a little something in the bank, now what can you add to it?

I was a college student once. Heck, I still live in a college town and fraternize with the best of them. So I understand what it means to be a spender. But if you take a look at what you’re actually spending your money on, you will see ways to cut back and start saving. Nationwide® posted an infographic on student earning and spending habits. College students are spending 40% of their money on technology, entertainment, clothes, etc.? The numbers sound about right (I probably spend a higher percentage on that, actually). But that’s 40% that you can cut back on.

College students are spending 40% of their money on technology, entertainment, clothes, etc.? The numbers sound about right (I probably spend a higher percentage on that, actually). But that’s 40% that you can cut back on.

Okay let’s be realistic. You aren’t going to be able to cut back that 40% completely. So let’s say you are able to cut back on a little over half of that. According to Nationwide®, you are making roughly $1,200/month. And now will be saving 25% of what you would have typically been spending.

Simple math done for you: ($1,200) x (.25) = $300 per month

That’s $300/month that you could potentially be saving for travel. This isn’t even including all of those Chipotle and Starbucks runs you could very likely live without, since that would be covered in the “Room and Board” expenses.

Let’s get crazy and say you’re able to cut back on the coffee and fast food a little. Maybe, just maybe, you could get a Keurig and some groceries and skip the coffee run and fast food binge 2x a week. *gasp*

Let’s crunch those numbers:

Simple math done for you: ($5 coffee) x (8 per month) = $40 per month

Simple math done for you: ($8 burrito) x (8 per month) = $64 per month

What you could potentially be saving

Wow! So if you cut back a little on the coffee and junk food, as well as the movies and entertainment *cough alcohol cough* you could potentially be saving… DRUMROLL PLEASE.

Simple math done for you: ($300 misc.) + ($40 coffee) + ($64 fast food) = $404 per month.

Say you want to travel on a budget of $4,000. According to this plan, you would only have to save for 10 months (less than a year!) in order to make enough money for that. And if you are part of the 41% who already have over $2,000 saved up, then you can cut that time in half. 5 months of saving? That’s a semester of college. Start saving now, and you can be traveling this summer break.

Traveling on a budget

Now that I’ve internet-shamed most of you into believing that you are, in fact, able to travel, stay tuned for my next post on how to travel on a budget. It is possible to backpack Europe for 5 weeks for just a few thousand dollars. And we’ve already established you have the ability to earn that much. Whether or not you choose to save it for traveling is up to you.

The sources and infographics are for rough reference points only.

Was this article convincing? What are some tips you have for saving money?

[…] for 5 weeks for roughly $4,000 (that’s even including airfare and housing!) In my post about Why Your Excuse “I Can’t Afford to Travel” is a Lie, we’ve established that you can, in fact, afford to […]

LikeLike